FXTM Information

FXTM, or Forex Time, is a global forex and CFD broker founded in 2011. The company is headquartered in Cyprus and is regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Services Commission (FSC) in Mauritius. FXTM offers a variety of trading instruments, including forex, metals, commodities, stocks, indices, cryptocurrencies. In terms of trading fees, FXTM offers variable spreads on most of its instruments, with spreads close to 0 pips.

FXTM also offers multiple choices of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are available in desktop, web, and mobile versions, which allows traders to trade on the go and from anywhere in the world.

FXTM Pros and Cons

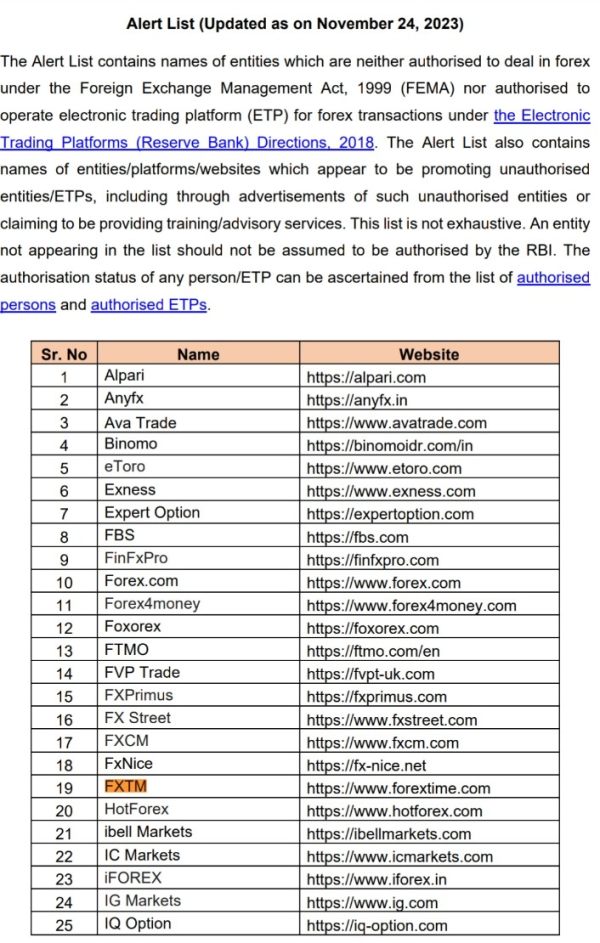

Is FXTM Legit?

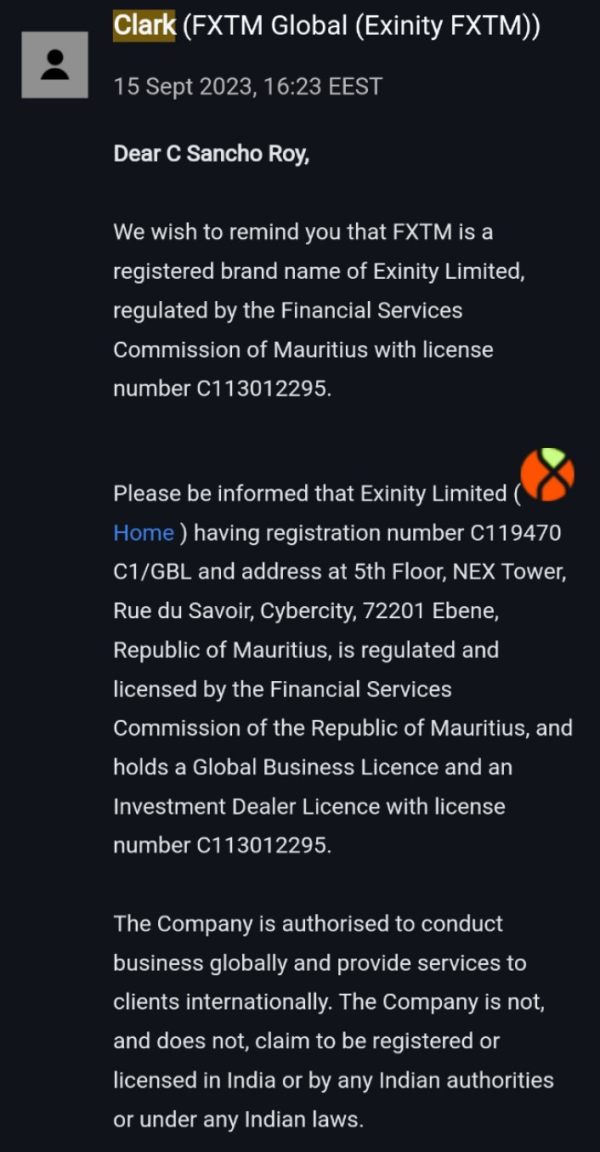

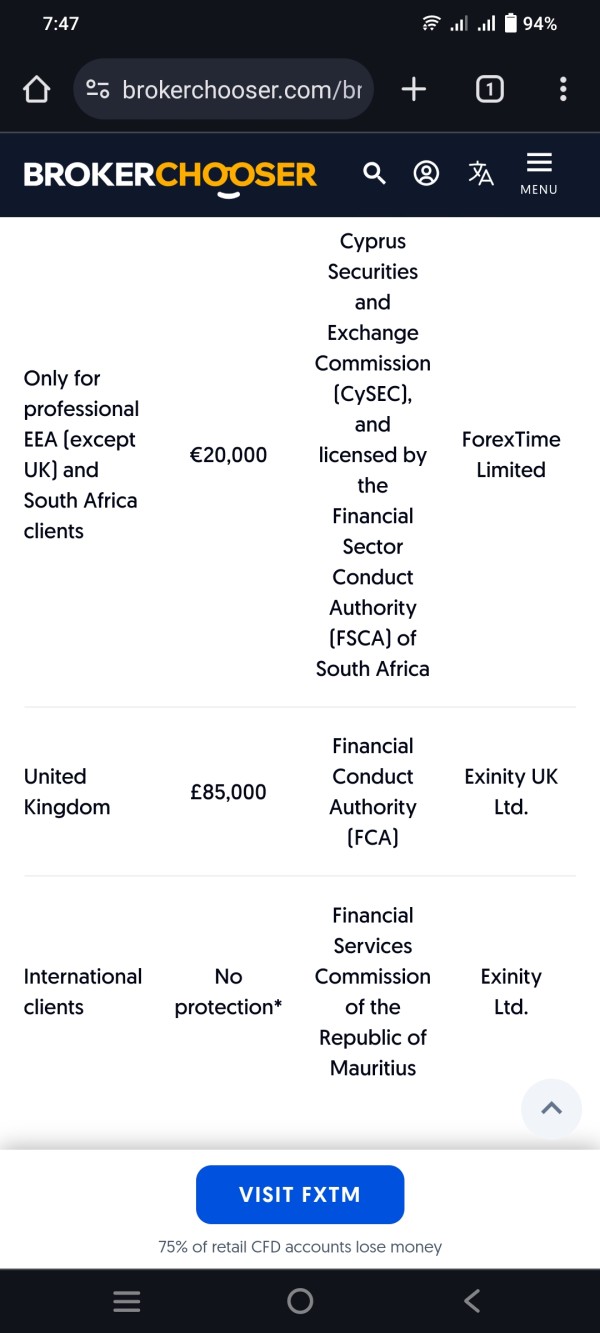

FXTM operates under a strong regulatory frame, and it has several entities that are regulated in different jurisdictions:

Market Intruments

FXTM offers over varioustradable instruments, covering forex, metals, commodities, stocks, indices, cryptocurrencies. However, this broker does not currently support trading on futures, options, and ETFs.

Account Type

FXTM offers three different types of trading accounts, which are the Advantage account, the Advantage Plus, and the Advantage Stocksaccount. All accounts require a minimum deposit requirement of 200. Each account type has its own unique features and benefits, such as different spreads, commissions, and trading instruments.

Demo Account

FXTM offers demo accounts for all its account types. These demo accounts allow traders to test their trading strategies in a risk-free environment using virtual funds. Demo accounts are also useful for new traders who want to learn how to trade before committing real money to live trading.

How to Open an Account?

- To open an account with FXTM, you first need to visit their website and click on the “OPEN ACCOUNT” button on the top right-hand corner of the page.

- This will take you to the account registration page where you will need to fill out some basic personal information like your name, email address, and phone number.

- Next, you will be asked to choose the type of account you want to open. FXTM offers three main account types - Advantage, Advantage Plus, Advantage Stocks, each with its own features and benefits. You will also need to select the base currency of your account and agree to the terms and conditions of the broker.

- Once you have selected your account type and base currency, you will be prompted to provide some additional personal information like your date of birth, occupation, and address. You will also need to answer a few questions about your trading experience and investment goals.

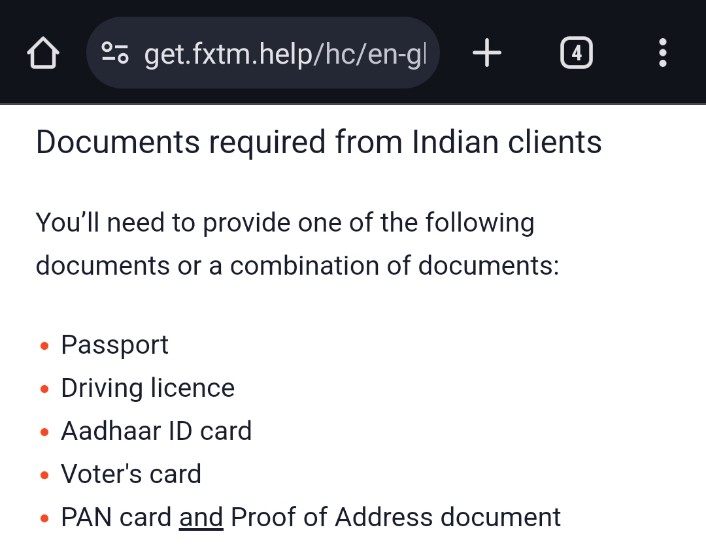

- After you have completed the registration process, you will need to verify your account by providing some additional documents like a copy of your ID or passport and a proof of address like a utility bill or bank statement.

- Finally, once your account is verified, you can then make your first deposit and start trading.

Leverage

FXTM offers leverage of up to 1:3000. It's recommended to use leverage wisely and only trade with funds you can afford to lose.

Spread and Commission

For the Advantage account, the spreads start from 0.0 pips, and $3.5 per lot traded on FX is charged. For the Advantage Plus account, the spreads start from 1.5 pips, but no commission. For the Advantage Stocks account, the spreads start from 6 cents, but no commission.

The spreads offered by FXTM are typically lower than those offered by many other brokers in the industry, particularly on the Advantage account. The Advantage Plus account, however, has slightly higher spreads, which is to be expected due to no commissions.

Trading Platform

FXTM offers three chocies of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as their proprietary mobile trading app.

FXTM Copy Trading

FXTM Invest is an advanced copy trading feature offered by FXTM, designed to make trading accessible to investors of all experience levels. With a low entry threshold of just $100, this platform allows users to automatically replicate the trades of experienced Strategy Managers. FXTM Invest stands out for its attractive pricing model, offering zero spreads on major FX pairs and a performance-based fee structure where investors only pay when their chosen Strategy Manager generates profits.

The process of getting started with FXTM Invest is streamlined into five simple steps: signing up or logging in to MyFXTM, selecting a Strategy Manager, opening an Invest account, making a deposit, and then watching as the system automatically copies your chosen manager's trades. This user-friendly approach, combined with the ability to maintain full control over your funds, makes FXTM Invest an appealing option for those looking to tap into the forex market with the guidance of seasoned professionals.

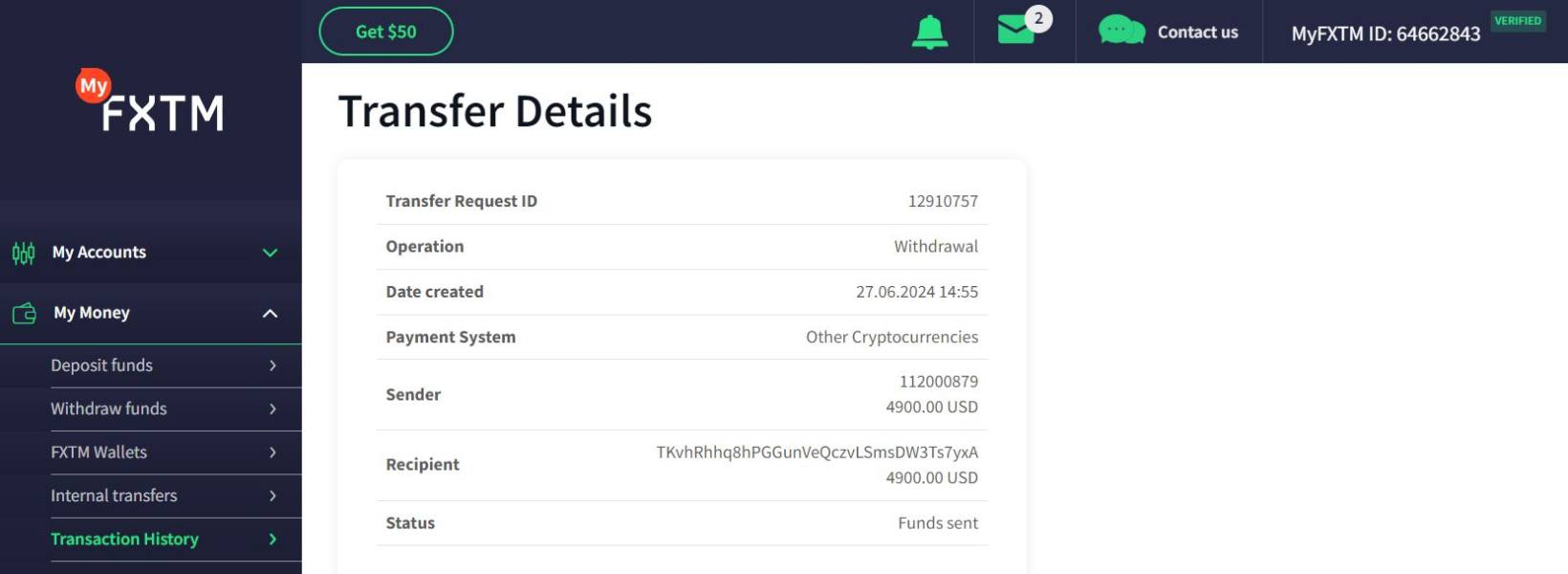

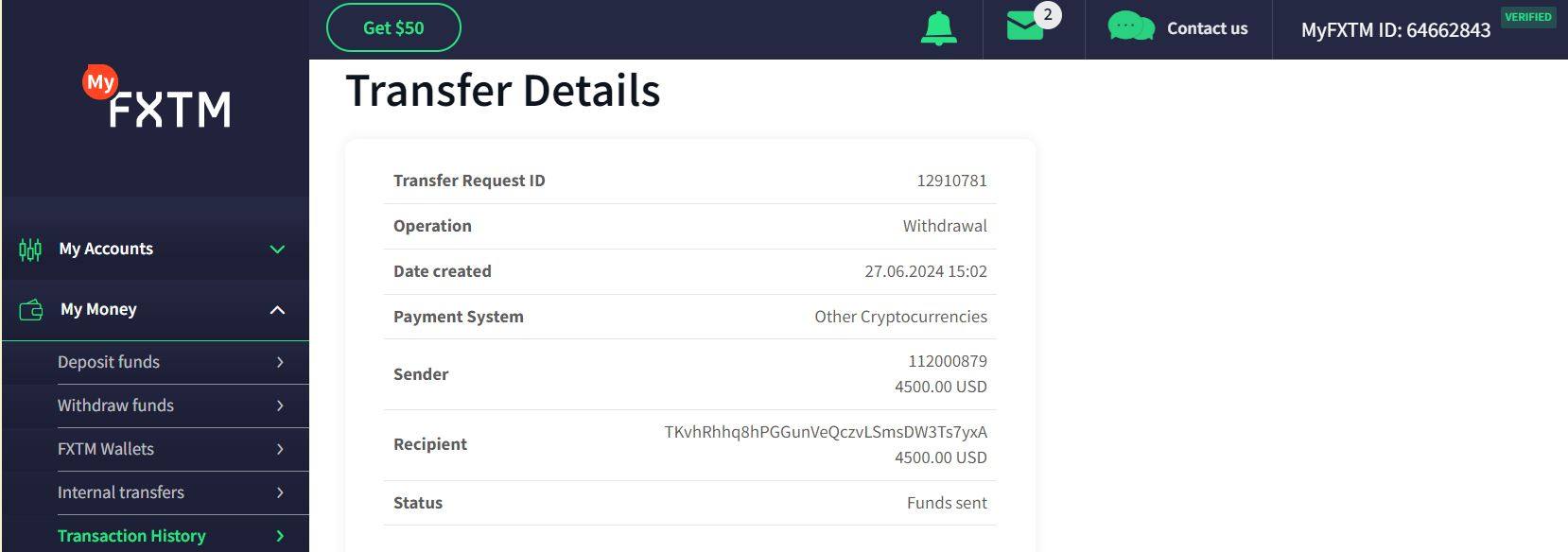

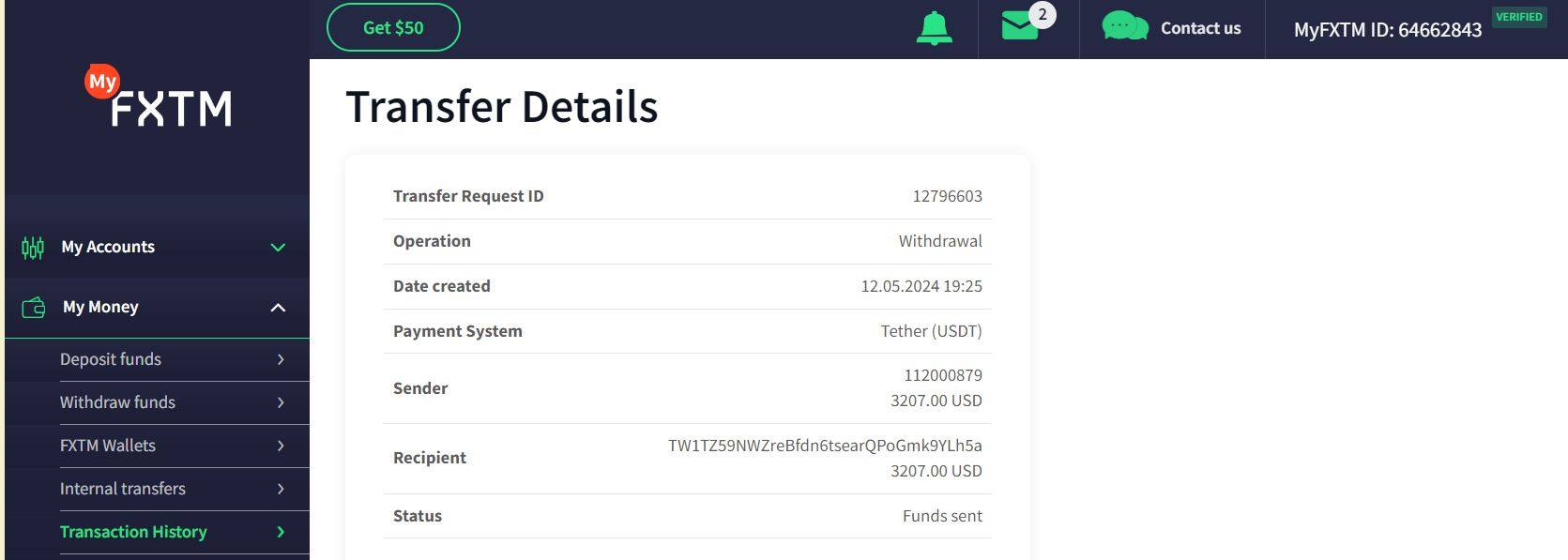

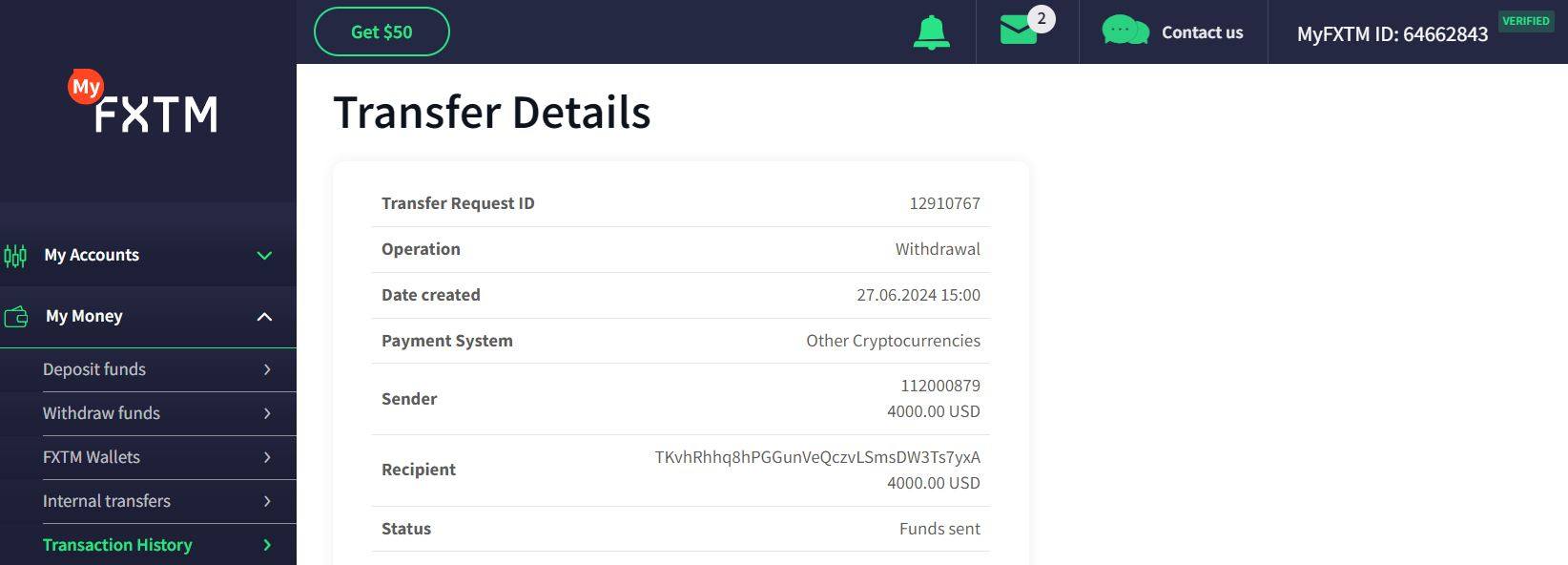

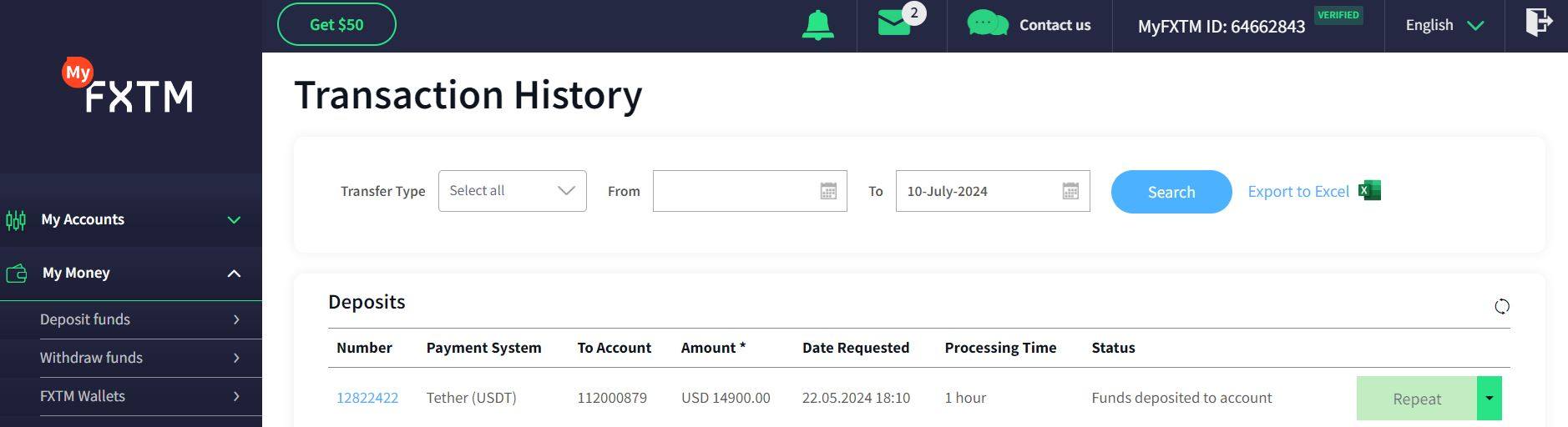

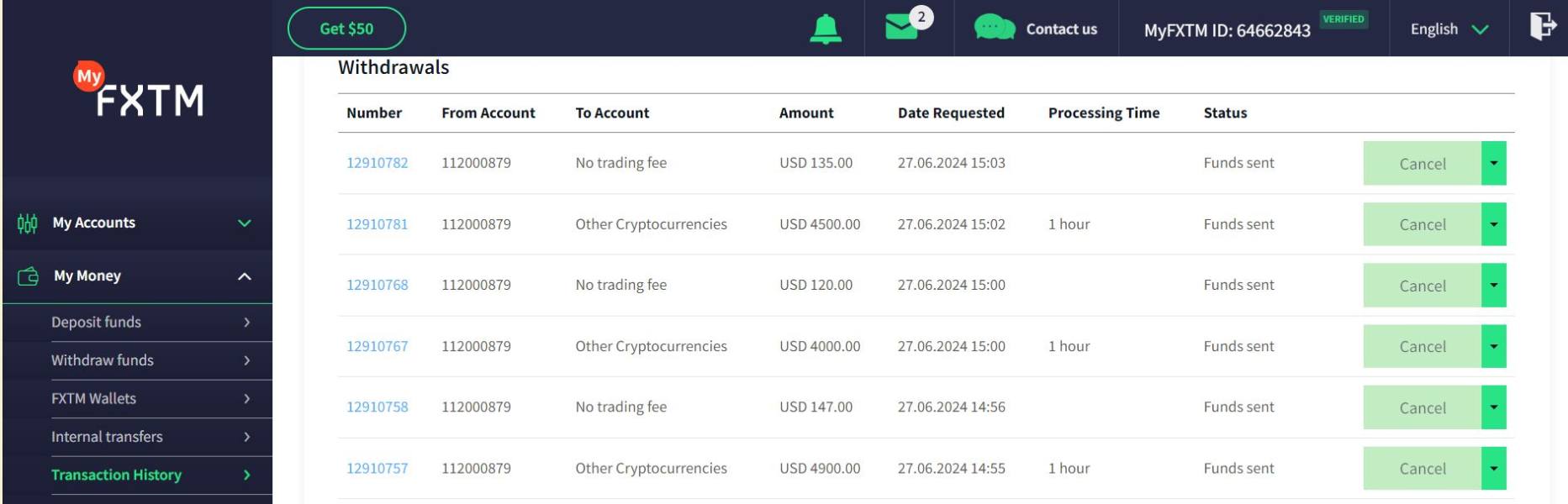

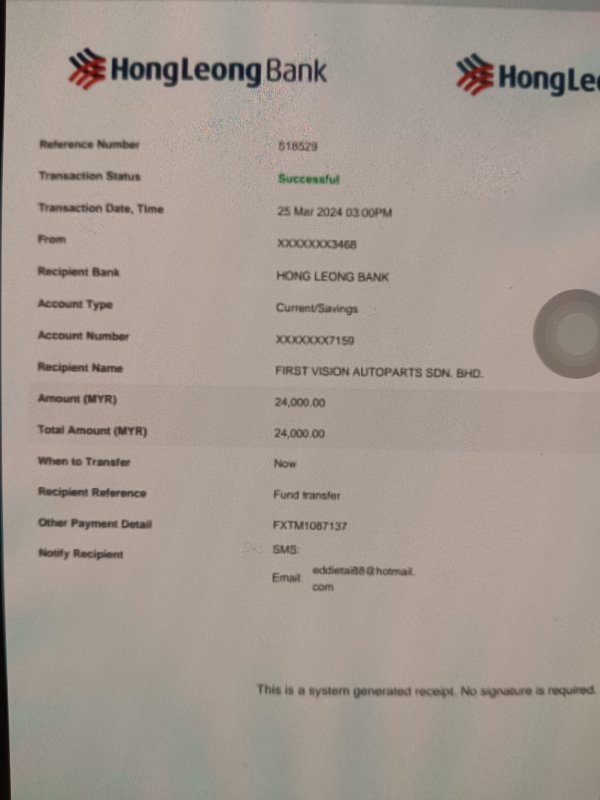

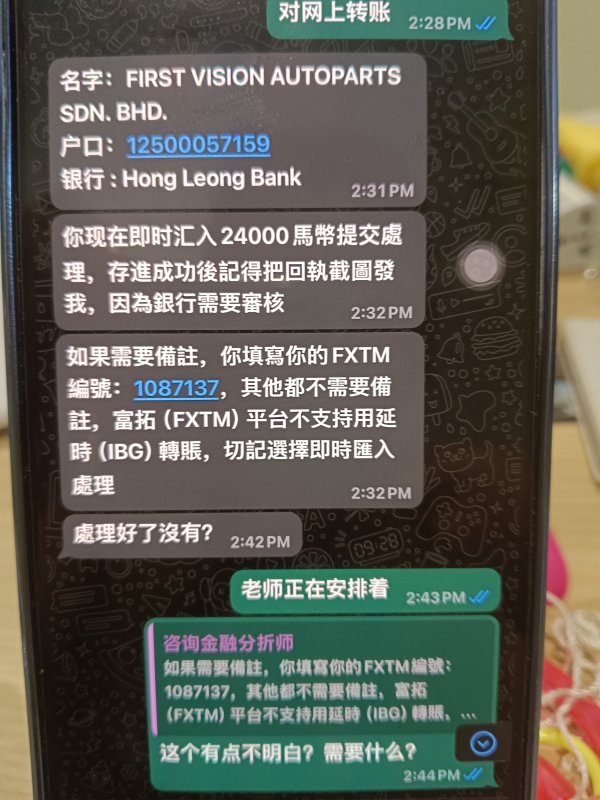

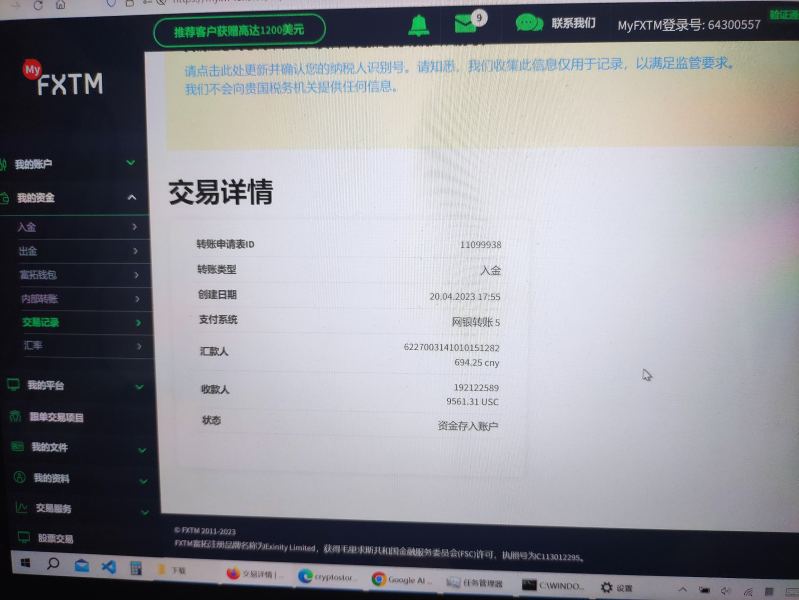

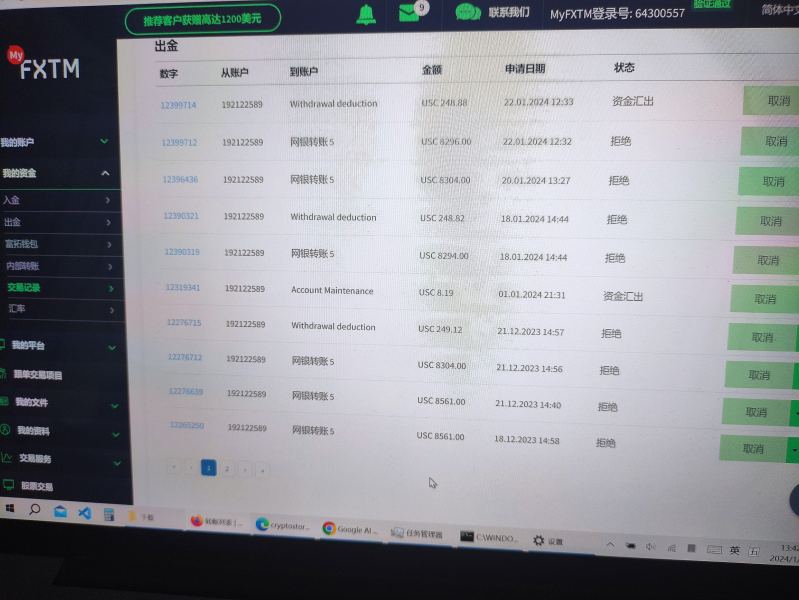

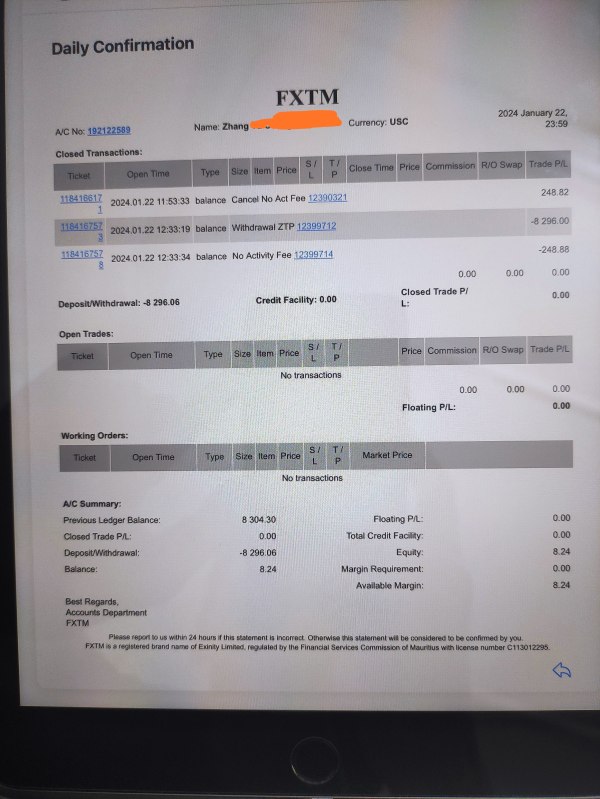

Deposit and Withdrawal

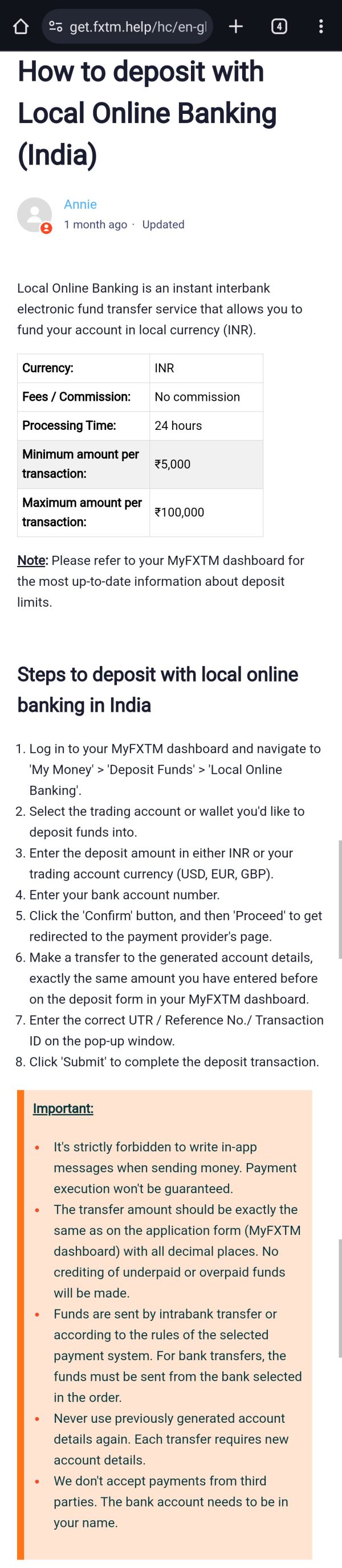

FXTM offers a variety of deposit and withdrawal options for its clients. Traders can deposit funds into their trading account using Kenyan/local transfers (local Indian payment methods: UPI and Netbanking, local Nigerian instant bank transfers, equity bank transfer, Ghanaian local transfer, Africa local solutions, M-Pesa, FasaPay, TC Pay Wallet), credit cards (Visa, MasterCard, Maestro, Google Pay), e-wallets (GlobePay, Skrill PayRedeem, Perfect Money, Neteller), and bank wire transfer.

FXTM charges a flat $3 transaction fee for any deposit or withdrawal less than $30 or equivalent, but no fees applied to deposits or withdrawals equal to $30 (or equivalent) or more.

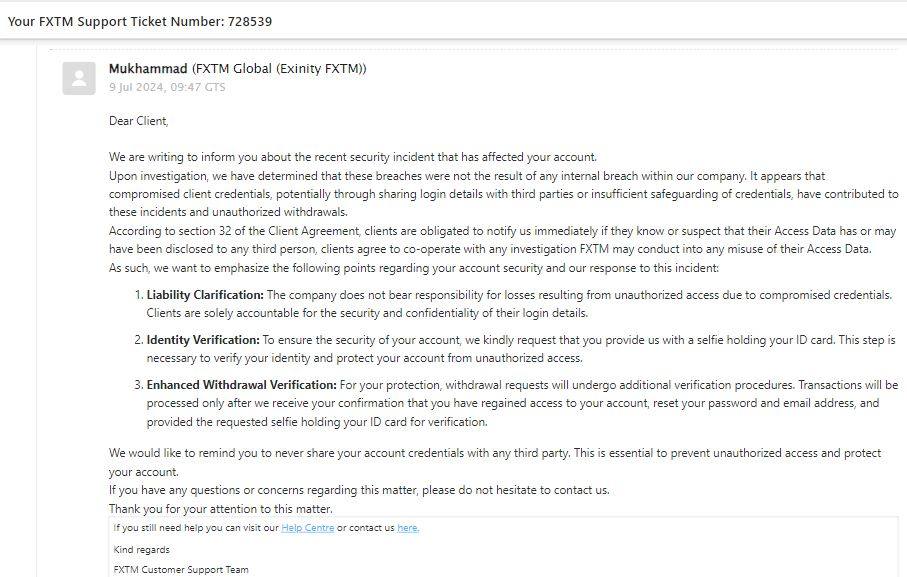

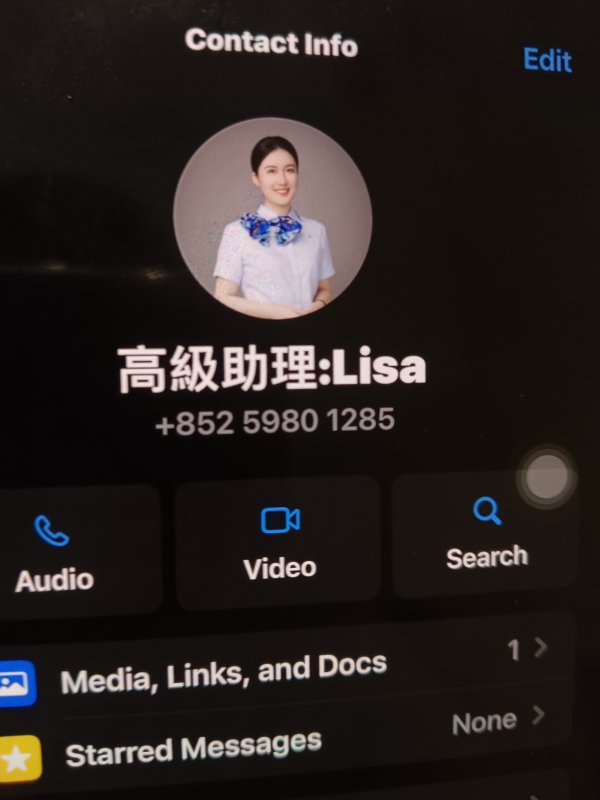

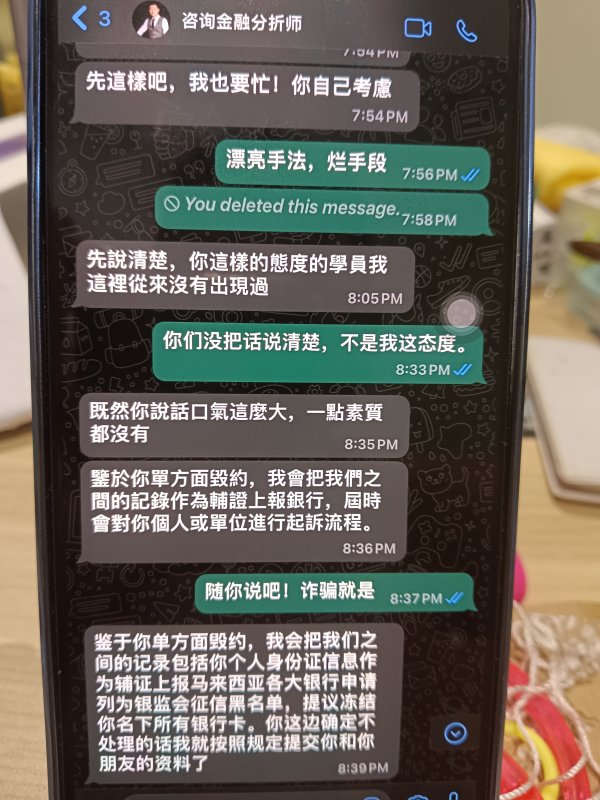

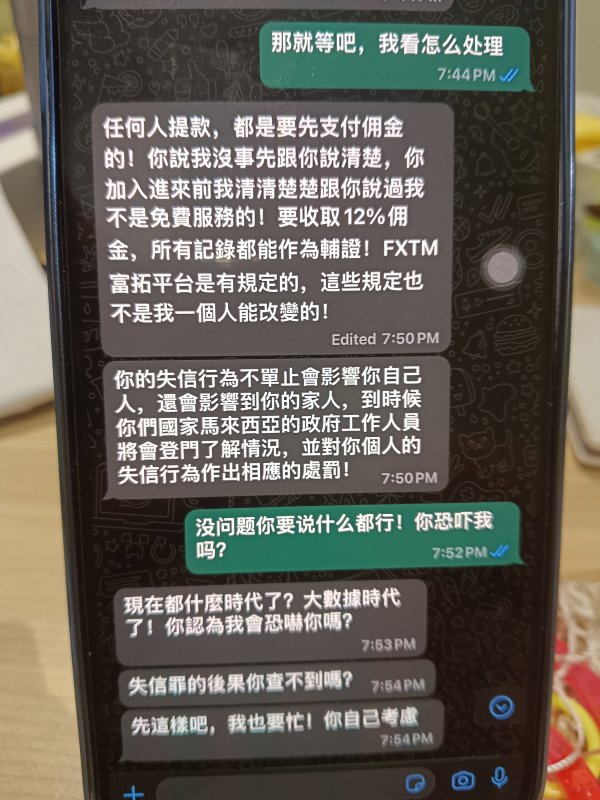

Customer Support

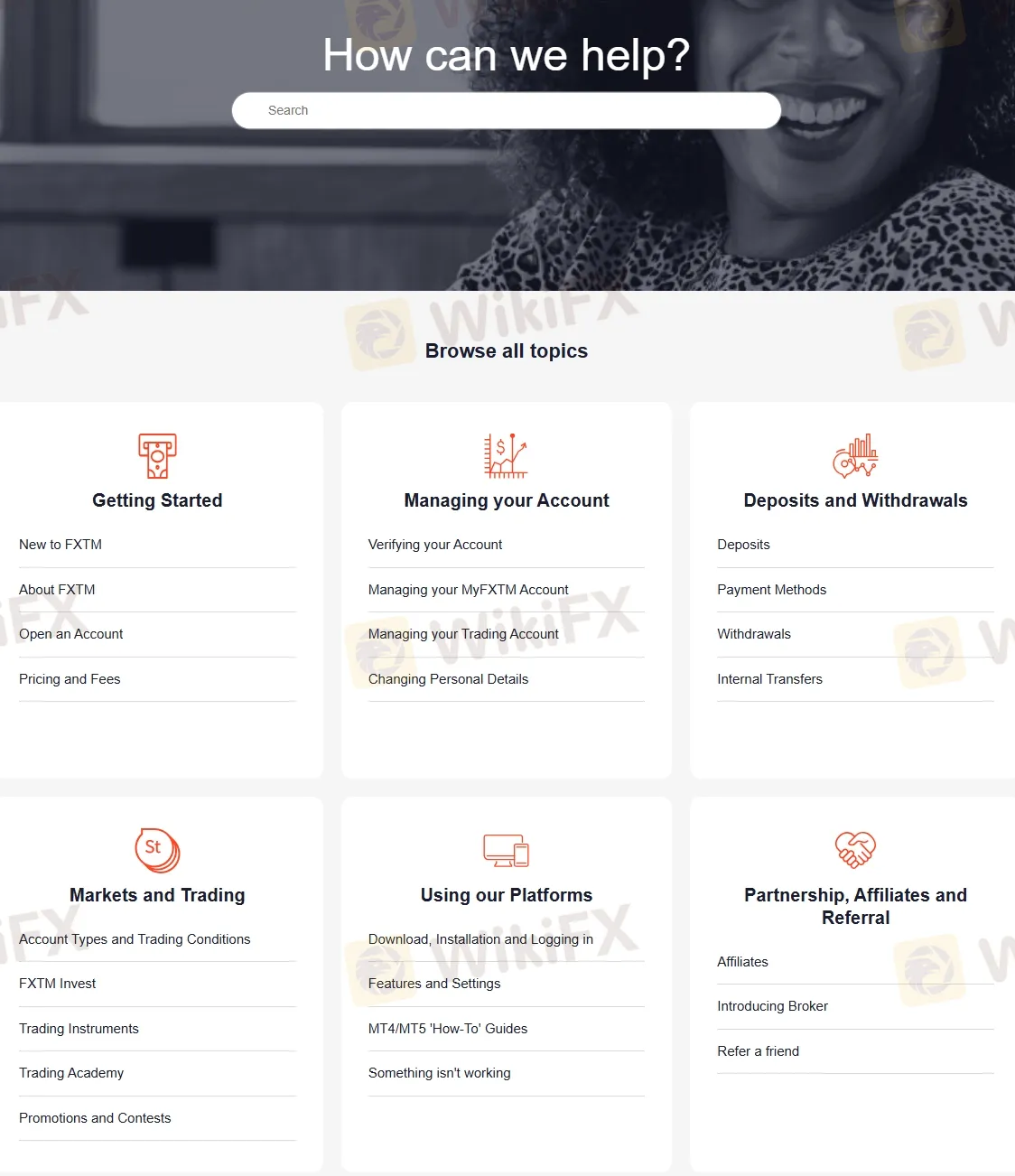

FXTM is known for providing excellent customer support to its clients, including live chat, contact form, Telegram, WhatsApp, and phone. The customer support team is available 24/5 and is multilingual, which means clients can communicate with them in their preferred language.

FXTM also provides an extensive Help Center section on their website that covers various topics, such as account opening, deposit and withdrawal methods, trading platforms, and more. This section is helpful for clients who prefer to find answers to their questions without contacting the support team.

Educational Resources

FXTM offers various educational resources including glossary, market analysis and guides. Besides, their educational resoucres are friendly both for beginners and professionals. For example, trading basics are suitable for beginners who want to learn some basics, while advanced guides are more suitable for traders who are experienced.

Conclusion

To sum up, FXTM is a well-regulated and respected forex broker with a wide range of market instruments, competitive trading conditions, and user-friendly trading platforms. They offer various account types without minimum deposit requirement and high leverage. FXTM's customer support is also responsive and helpful, and their educational resources are very useful for both novice and experienced traders.

FAQs

Is FXTM legit?

Yes, FXTM is regulated by FCA and FSC (Offshore).

What trading instruments are available on FXTM?

FXTM offers a range of trading instruments including forex, metals, commodities, stocks, indices, cryptocurrencies.

What is the minimum deposit required to open an account on FXTM?

$/€/£200.

What trading platforms are available on FXTM?

FXTM offers three chocies of trading platforms including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as mobile trading.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then.