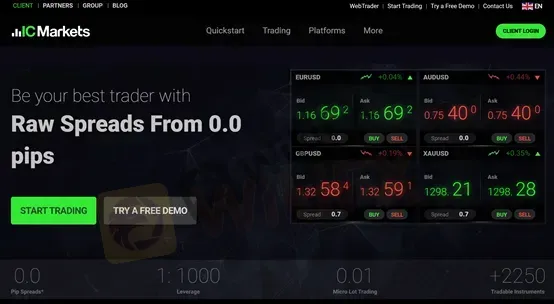

What is IC Markets?

IC Markets Global is an Australian online forex and CFD broker that provides traders access to the global financial markets. The company was founded in 2007 and is regulated by the Australian Securities and Investments Commission (ASIC). IC Markets offers a range of trading instruments, including forex, indices, commodities, and cryptocurrencies, and provides traders with advanced trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader. The company also offers 24/7 customer support and a variety of educational resources for traders of all levels.

Is IC Market Legit?

IC Markets Global maintains regulatory compliance in both Australia and Cyprus, adhering to the respective financial regulatory standards in these jurisdictions. Regulatory oversight by ASIC and CYSEC contributes a safer trading environment for clients.

IC Markets' Australian entity, INTERNATIONAL CAPITAL MARKETS PTY. LTD., regulated by ASIC under license number 335692, holding a license for Market Making (MM).

IC Markets' enropean entity, IC Markets (EU) Ltd, regulated by CYSEC under regulatory number 362/18, holding a license for Maket Making ( MM) as well.

WikiFX's investigation team personally visited the registered address located at Omonoias, 141, The Maritime Centre, Block B, 1st floor, 3045, Limassol, Cyprus. Notably, the IC Markets Global logo was prominently displayed on billboards in the vicinity of the building. Hence, their visit to the location confirmed that IC Markets was indeed operating from the officially designated regulatory address.

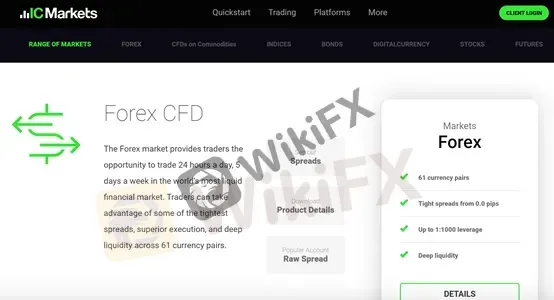

Market Instruments

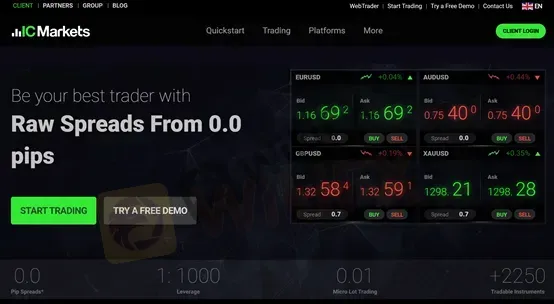

IC Markets Global offers a wide range of over 2250 tradable instruments to trade, including forex pairs, commodities, stocks, cryptocurrencies, indices, bonds, and futures. This provides traders with the opportunity to diversify their investment portfolio and access multiple markets and assets. The company offers competitive spreads and low commissions on all instruments, making it a popular choice among traders.

Minimum Deposit

IC Markets Global requires a minimum deposit of $200 for traders to open an account. In the industry, many established brokers frequently impose minimum deposit requirements that surpass $500 or even reach $1,000. In contrast, certain major players such as Avatrade and Aixtrader only mandate minimum deposits of $100 and $0, respectively. So, IC Markets's minimum deposit requirement seems to be in the “middle”.

Here is the comparison of IC Markets Global minimum deposit with Avatrade, Exness, and Axitrader:

Account Type

C Markets offers traders a range of account types with different trading platforms, commissions, and spreads. The CTrader and Raw spread accounts charge a commission of $3 and $3.5 respectively but offer spreads from 0.0 pips, while the Standard account has no commission but wider spreads from 0.6 pips.

A demo account and Islamic account are also available. Although the minimum deposit of $200 may be high for some traders, the variety of account types and competitive spreads on some accounts may make up for it. However, traders should note that commissions are charged on all other accounts apart from the Standard account, and there is limited information on account features.

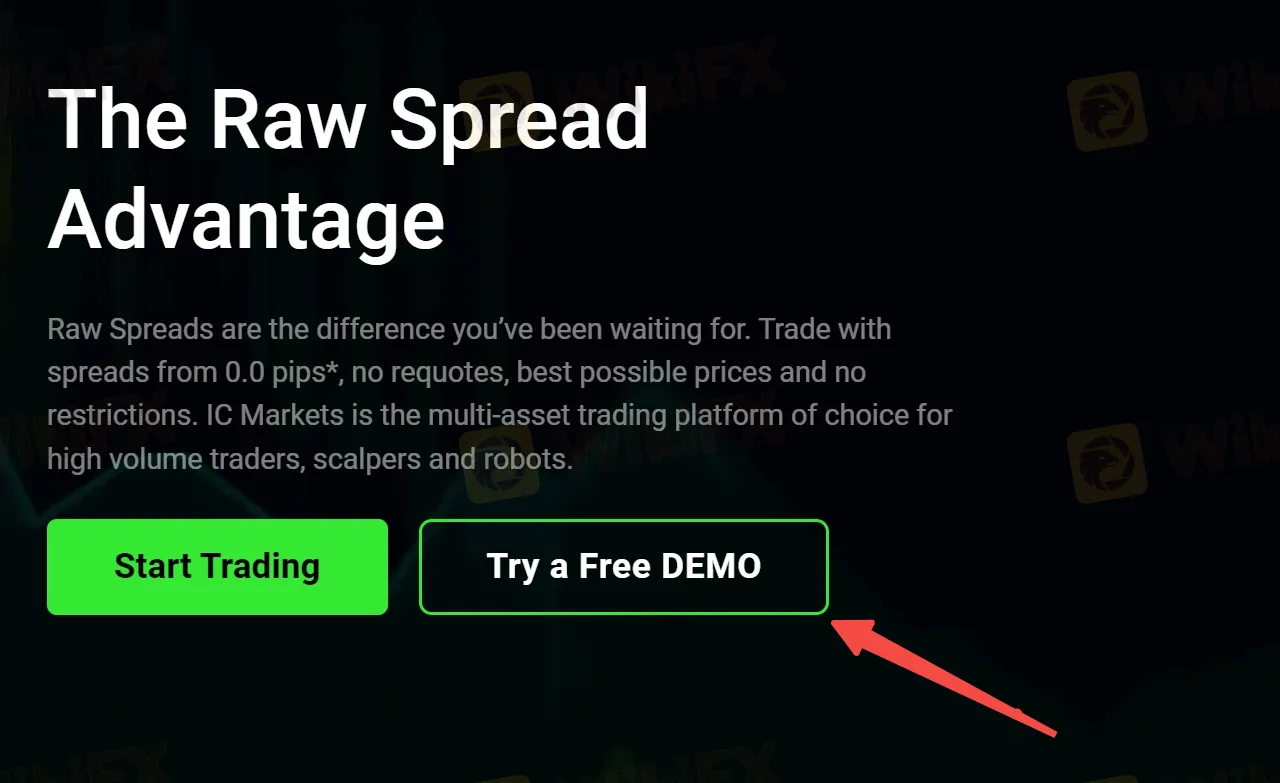

Demo Account

IC Markets Global offers a free advanced demo account for beginner traders to practice on, which lasts for 30 days.

Users who open a demo account can enjoy the following features:

- Access to Raw Pricing

- Spreads Starting at 0.0 Pips

- Fast Order Execution

- Available on MT4, MT5 and cTrader platforms

However, demo accounts aim to mimic real markets but function in a simulated environment. This means there are significant differences compared to real accounts, including not relying on real-time market liquidity, encountering price delays, and having access to certain products that may not be tradable on live accounts.

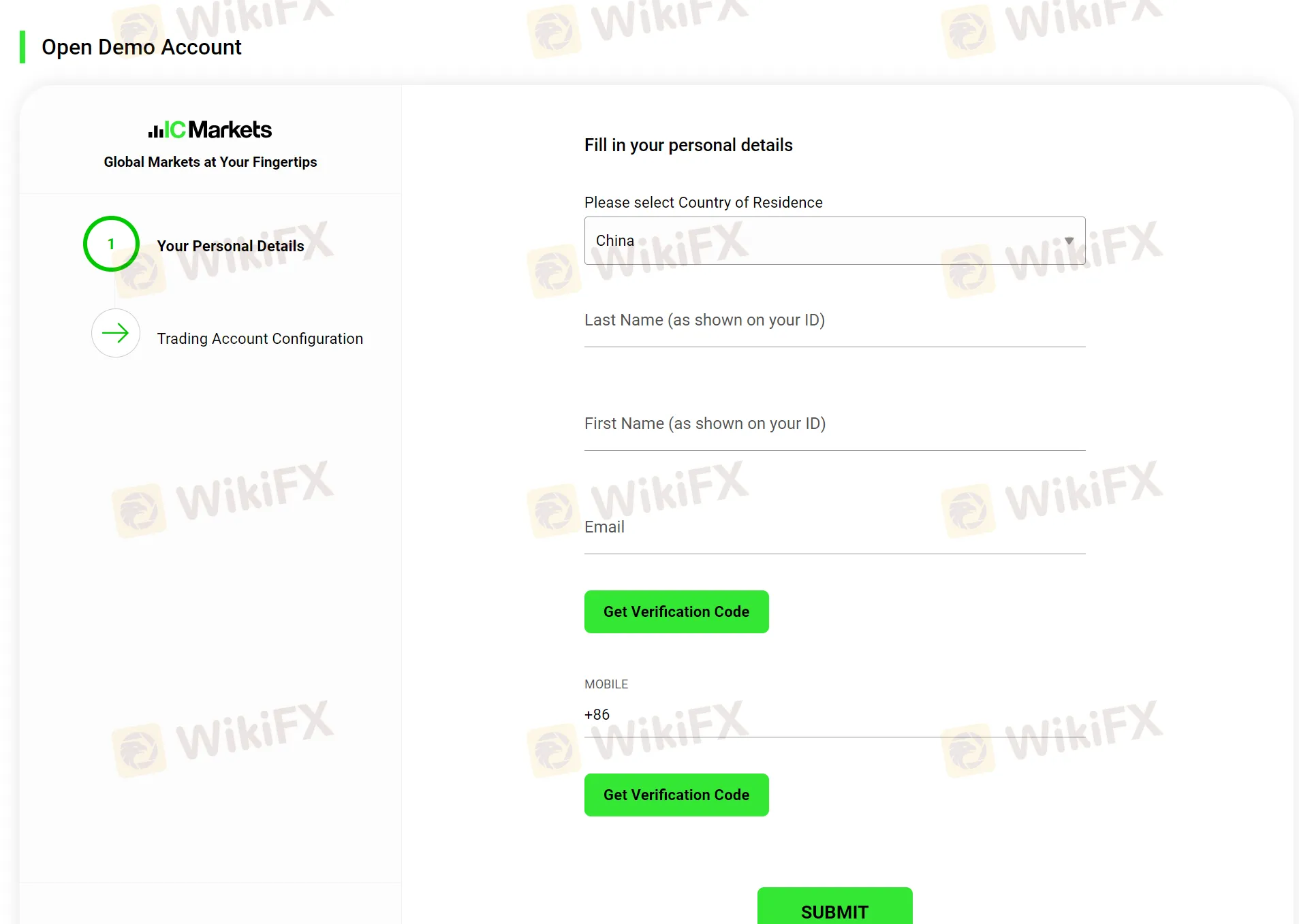

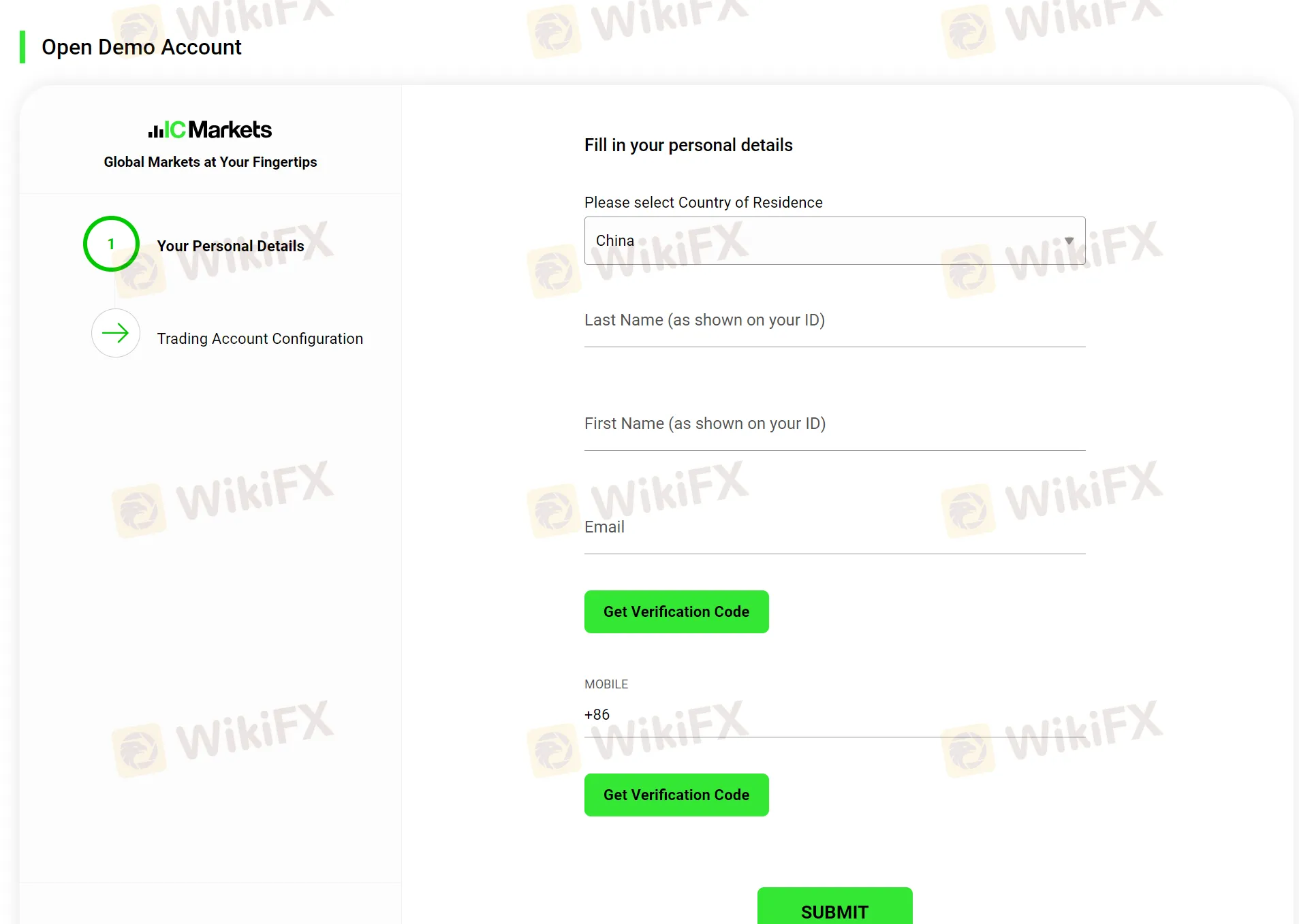

Opening a demo account is simple:

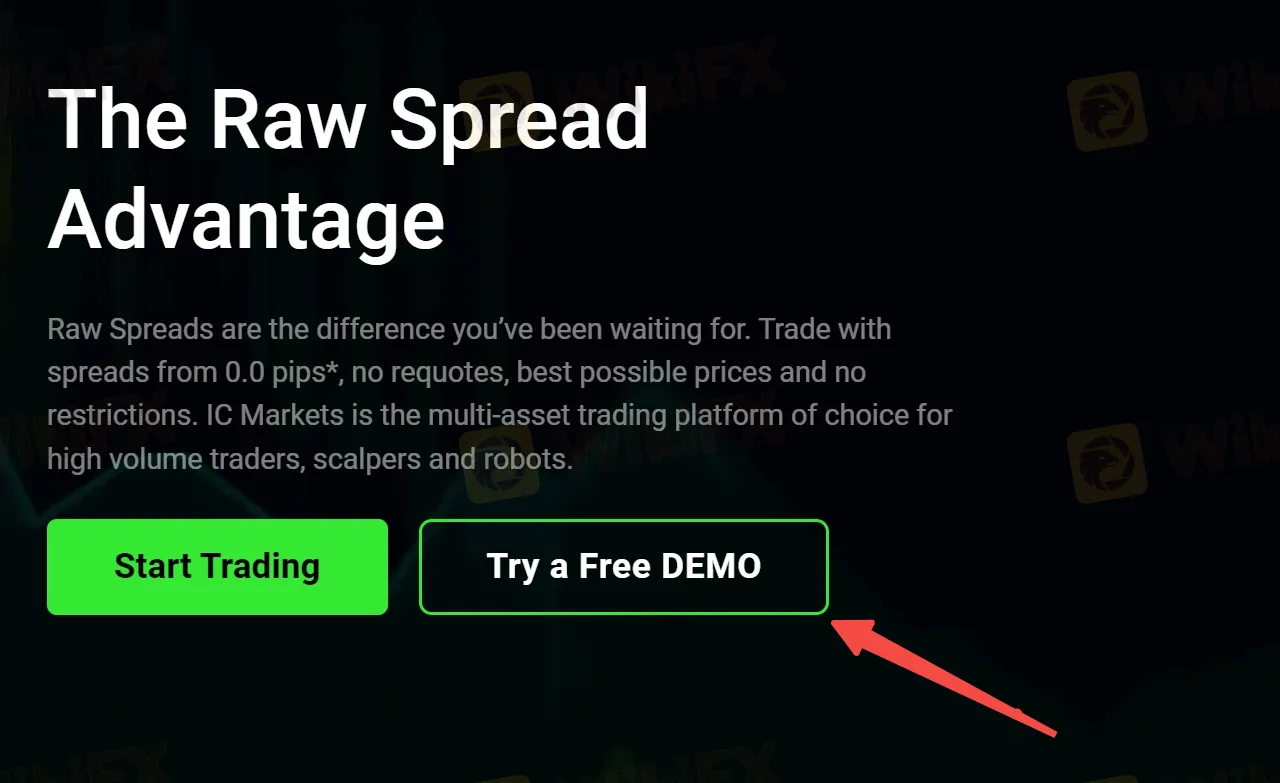

Step 1: click the “Try a Free DEMO” button on the homepage of IC Markets.

Step 2: Fill in your personal info, including your country of residence, name, email, phone number to get a verification code.

Step 3: Choose to demo accounts on your preferrable trading platform, MT4, MT5, or cTrader. Then choose your account currency, virtual funds, starting from $200 to $5,000,000, your desired leverage level.

Step 4: Log into your demo account and start trading.

Leverage

IC Markets' maximum leverage offering of up to 1:500 can be beneficial for experienced traders who know how to manage their risks well. The high leverage can potentially magnify the profits of a successful trade, enabling traders to take advantage of larger positions in the market.

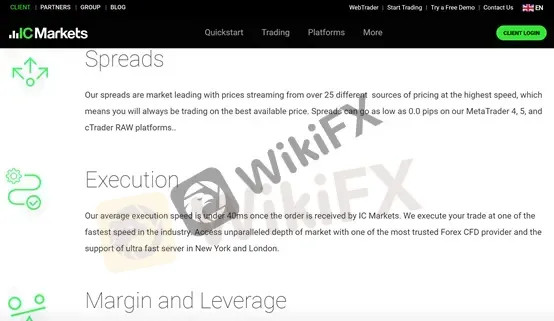

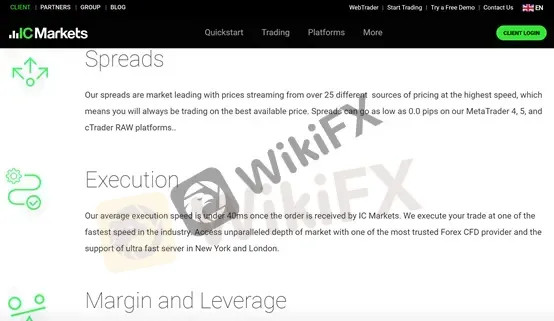

Spreads & Commissions

IC Markets Global is known for its tight spreads and low commissions, making it a popular choice among traders. The broker offers a variety of account types to choose from, including the Raw Spread account with spreads starting from 0.0 pips and a $3.5 commission per lot traded, and the Standard account with spreads starting from 0.6 pips and no commission. The cTrader account also offers low spreads starting from 0.0 pips, with a $3 commission per lot traded.

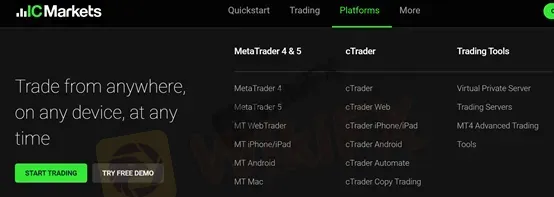

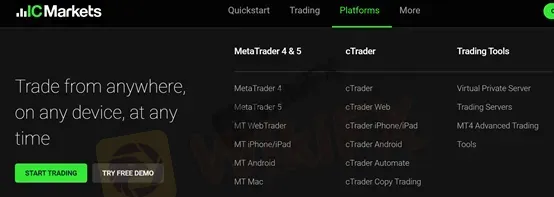

Trading Platforms

IC Markets Global offers its clients a variety of trading platforms, including the popular MetaTrader4 and MetaTrader5 platforms as well as the cTrader platform.

The MetaTrader4 and MetaTrader5 platforms are similar and offer a range of trading tools and indicators, as well as the ability to use Expert Advisors (EAs) and automate trading strategies.

The cTrader platform, on the other hand, offers advanced charting capabilities and a variety of order types. However, it has a steeper learning curve and limited customization options compared to the MetaTrader4 and MetaTrader5 platforms.

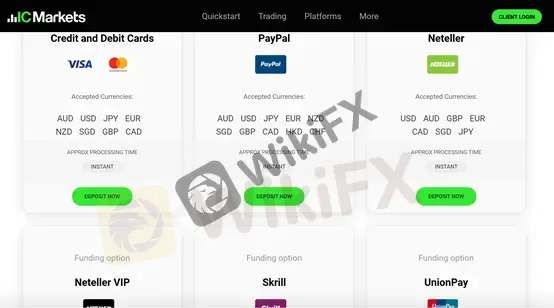

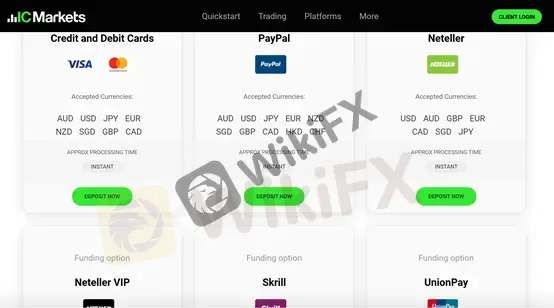

Deposit & Withdrawal

IC Markets Global offers a variety of deposit and withdrawal options, including Neteller, Skrill, bank transfer, VISA, Mastercard, Paypal, credit/debit cards, Poli, wire transfer, rapidpay, and klarna. IC Markets Global does not charge any fees for deposits and withdrawals, however, additional fees may occur at some banking institutions.

Withdrawal requests have a cut off time at 12:00 AEST/AEDT, and take up to 10 business days to process depending on the bank. International bank wire transfers take up to 14 days and incur additional intermediary and/or beneficiary fees. Credit/debit card withdrawals are processed free of charge and take 3-5 business days to reach your credit card. Paypal/Neteller/Skrill withdrawals are processed instantly and free of charge, but must be made from the same account as the initial funds were sent from.

Customer Service

IC Markets Global provides a strong customer care dimension with 24/7 availability for customer support. Clients can reach out to the support team via phone or email, and can expect prompt response times to email inquiries. However, there is no live chat option available for immediate assistance, and phone support may have international charges, which could be a disadvantage for some clients.

Frequently Asked Questions (FAQs)

What is the minimum deposit required to open an account with IC Markets?

$200.

What are the available deposit and withdrawal methods on IC Markets?

Neteller, Skrill, bank transfer, VISA, Mastercard, Paypal, credit/debit cards, Poli, wire transfer, rapidpay, and klarna.

What trading platforms are available on IC Markets?

MetaTrader4, MetaTrader5, and cTrader.

What is the maximum leverage offered by IC Markets?

1:500.

Does IC Markets Global charge any fees for deposits and withdrawals?

IC Markets does not charge any fees for deposits and withdrawals. However, additional fees may occur at some banking institutions.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX